The “Make in India” initiative, launched by the Government of India in 2014, has emerged as a cornerstone of India’s economic growth and manufacturing prowess. This ambitious program aims to position India as a global manufacturing hub, attracting significant foreign direct investment (FDI) and generating employment opportunities. By fostering a conducive business environment, streamlining regulations, and incentivizing domestic manufacturing, the “Make in India” initiative has the potential to transform India’s economic landscape.

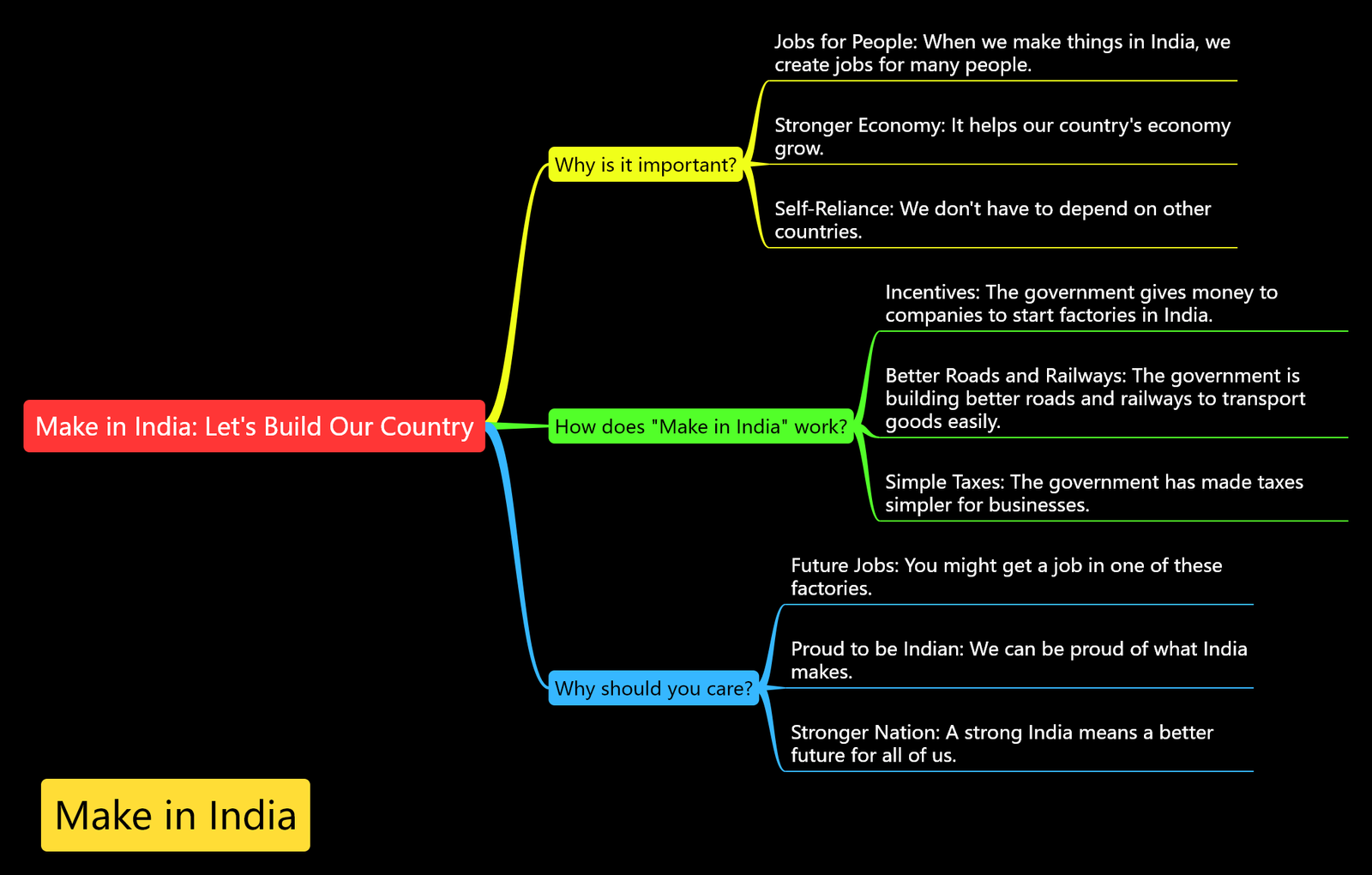

Understanding “Make in India”

At its core, the “Make in India” initiative seeks to promote India as a global manufacturing destination. It aims to attract foreign investment, create jobs, and boost exports. The initiative emphasizes the importance of ease of doing business, skill development, and infrastructure development. By simplifying regulatory procedures, providing fiscal incentives, and investing in infrastructure, the government aims to create a favourable environment for domestic and foreign manufacturers.

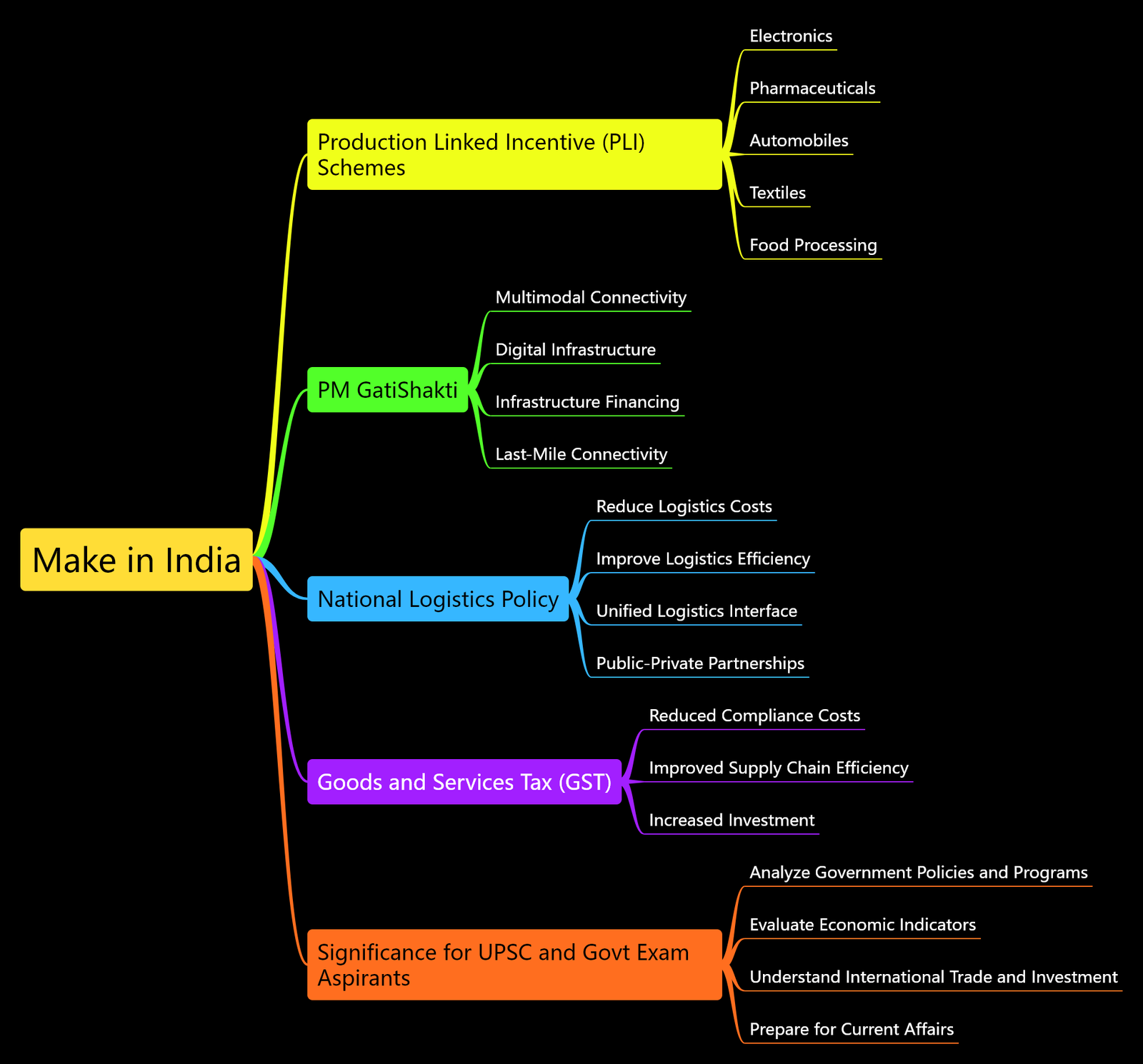

Key Components of “Make in India”

Several key components underpin the “Make in India” initiative, each playing a crucial role in its success:

1. Production Linked Incentive (PLI) Schemes:

The Production Linked Incentive (PLI) Schemes are a flagship program under the “Make in India” initiative. These schemes offer financial incentives to domestic manufacturers, encouraging them to increase production, boost exports, and create jobs. PLI schemes have been implemented across various sectors, including electronics, pharmaceuticals, automobiles, textiles, and food processing.

- Benefits of PLI Schemes:

- Increased Production: PLI schemes incentivize manufacturers to scale up production, leading to higher output and economic growth.

- Export Promotion: By offering incentives linked to exports, PLI schemes encourage manufacturers to target international markets, boosting India’s export earnings.

- Job Creation: Increased production and investment in manufacturing facilities lead to the creation of new jobs, especially in rural and semi-urban areas.

- Technological Upgradation: PLI schemes often require manufacturers to adopt advanced technologies and processes, leading to improved productivity and quality.

- Case Studies of Successful PLI Beneficiaries:

- Electronics Manufacturing: Several domestic and multinational companies have benefited from PLI schemes in the electronics sector, leading to increased production of mobile phones, televisions, and other electronic devices.

- Pharmaceuticals: Indian pharmaceutical companies have used PLI incentives to expand their manufacturing capabilities and develop innovative drugs.

- Automobiles: The automotive industry has also benefited from PLI schemes, with companies investing in new manufacturing facilities and research and development.

2. PM GatiShakti:

The Prime Minister’s Gati Shakti National Master Plan is a comprehensive approach to infrastructure development. It aims to integrate various modes of transportation and logistics, ensuring the seamless movement of goods and services across the country. By reducing logistics costs and improving connectivity, PM GatiShakti will enhance India’s manufacturing competitiveness.

- Key Features of PM GatiShakti:

- Multimodal Connectivity: PM GatiShakti focuses on developing multimodal transportation hubs, combining rail, road, and water transport to optimize logistics efficiency.

- Digital Infrastructure: The plan emphasizes the importance of digital infrastructure, including 5G networks and digital platforms, to facilitate efficient logistics and supply chain management.

- Infrastructure Financing: PM GatiShakti provides a framework for coordinated infrastructure financing, attracting public and private investment.

- Focus on Last-Mile Connectivity: The plan prioritizes the development of last-mile connectivity, especially in rural areas, to ensure that the benefits of infrastructure development reach the grassroots level.

3. National Logistics Policy:

The National Logistics Policy aims to streamline logistics operations and reduce logistics costs. By improving the efficiency of the logistics sector, India can attract more manufacturing investments and reduce the cost of doing business.

- Key Objectives of the National Logistics Policy:

- Reduce Logistics Costs: The policy seeks to reduce logistics costs as a percentage of GDP, making Indian goods more competitive in domestic and international markets.

- Improve Logistics Efficiency: By streamlining processes, digitizing documentation, and promoting the use of technology, the policy aims to enhance the efficiency of logistics operations.

- Develop a Unified Logistics Interface: The policy promotes the development of a unified logistics interface to facilitate the seamless movement of goods across different modes of transport.

- Foster Public-Private Partnerships: The policy encourages public-private partnerships to invest in logistics infrastructure and services.

4. Goods and Services Tax (GST):

The implementation of the Goods and Services Tax (GST) has unified India’s tax system, simplifying the process for businesses and reducing compliance costs. This has made India a more attractive destination for manufacturing investments.

- Benefits of GST for Manufacturing:

- Reduced Compliance Costs: GST has simplified the tax structure, reducing the compliance burden on manufacturers.

- Improved Supply Chain Efficiency: GST has led to the removal of inter-state barriers, making the movement of goods more efficient.

- Increased Investment: The simplified tax regime has attracted more investment in the manufacturing sector.

The Significance of “Make in India” for UPSC and Govt Exam Aspirants

The “Make in India” initiative is a crucial topic for UPSC and government exam aspirants, as it reflects the government’s commitment to industrial development, economic growth, and self-reliance. By understanding the key components of this initiative, aspirants can:

- Analyze Government Policies and Programs: The “Make in India” initiative is a prime example of the government’s efforts to implement industrial policies. By studying this initiative, aspirants can gain insights into the government’s policy-making process and its impact on the economy.

- Evaluate Economic Indicators: The “Make in India” initiative has led to increased manufacturing output, exports, and job creation. Aspirants can analyze economic indicators such as GDP growth, industrial production, and employment data to assess the impact of this initiative.

- Understand International Trade and Investment: The “Make in India” initiative aims to attract foreign investment and promote exports. By studying this initiative, aspirants can gain knowledge about international trade theories, investment policies, and global value chains.

- Prepare for Current Affairs: The “Make in India” initiative is a frequently discussed topic in current affairs. By understanding this initiative, aspirants can be well-prepared for current affairs questions in the UPSC and government exams.

The Role of BNC Academy in Empowering Aspirants

BNC Academy plays a crucial role in empowering UPSC and government exam aspirants by providing high-quality education and training. Through its free courses, blogs, and other resources, BNC Academy helps aspirants:

- Master the Syllabus: BNC Academy offers comprehensive courses that cover the entire syllabus of the UPSC and government exams.

- Develop Critical Thinking Skills: BNC Academy encourages critical thinking and analysis through its engaging content and discussions.

- Stay Updated with Current Affairs: BNC Academy provides regular updates on current affairs, including the latest developments in the “Make in India” initiative.

- Practice with Mock Tests: BNC Academy offers a wide range of mock tests to help aspirants assess their preparation and improve their performance.

By leveraging the resources provided by BNC Academy, aspirants can enhance their understanding of the “Make in India” initiative and other relevant topics, thereby increasing their chances of success in the UPSC and government exams.

Conclusion

The “Make in India” initiative has the potential to transform India into a global manufacturing powerhouse. By creating a conducive business environment, attracting foreign investment, and promoting domestic manufacturing, the initiative can drive economic growth, generate employment opportunities, and improve the standard of living for millions of Indians. As India continues to rise as a global economic player, the “Make in India” initiative will remain a key driver of its progress and prosperity.

Key Topics Related to “Make in India”:

- Industrial Policy

- Economic Growth

- Foreign Direct Investment

- Manufacturing Sector

- Infrastructure Development

- Logistics and Supply Chain Management

- Taxation

- International Trade

- Skill Development

- Government Initiatives

- Economic Reforms

- Public-Private Partnerships

By understanding these topics and their interconnections, aspirants can comprehensively understand the “Make in India” initiative and its implications for India’s economic future.

Mock Test on “Make in India”:

Choose the correct answer for each question.

- In which year was the “Make in India” initiative launched?

- A. 2012

- B. 2014

- C. 2016

- D. 2018

- What is the primary goal of the “Make in India” initiative?

- A. Increase imports

- B. Position India as a global manufacturing hub

- C. Reduce infrastructure development

- D. Focus only on service industries

- Which sectors have benefitted from PLI schemes under “Make in India”?

- A. Banking

- B. Tourism

- C. Electronics

- D. Education

- What does PLI stand for?

- A. Production Linked Investments

- B. Production Linked Incentives

- C. Product Level Index

- D. Policy Linked Initiatives

- Which flagship infrastructure plan is associated with seamless logistics in India?

- A. PM GatiShakti

- B. BharatNet

- C. Startup India

- D. Digital India

- What is one major benefit of the GST for manufacturing?

- A. Increased import duties

- B. Removal of inter-state barriers

- C. Complexity in taxation

- D. Focus on service sector growth

- Which plan emphasizes multimodal transportation hubs?

- A. National Logistics Policy

- B. PM GatiShakti

- C. Digital India

- D. Skill India

- The National Logistics Policy aims to reduce logistics costs as a percentage of:

- A. Imports

- B. GDP

- C. FDI

- D. Exports

- Which component focuses on financial incentives to boost manufacturing?

- A. PM GatiShakti

- B. PLI Schemes

- C. National Logistics Policy

- D. Skill India

- The ease of doing business is a key focus of:

- A. Digital India

- B. Startup India

- C. Make in India

- D. Skill India

- PM GatiShakti focuses on which type of connectivity?

- A. Urban-only connectivity

- B. Last-mile connectivity

- C. International connectivity

- D. Satellite connectivity

- PLI schemes encourage manufacturers to adopt:

- A. Traditional methods

- B. Advanced Technologies

- C. Outdated infrastructure

- D. Manual labour-only processes

- Which policy aims to develop a unified logistics interface?

- A. GST

- B. National Logistics Policy

- C. PM GatiShakti

- D. PLI Schemes

- The GST implementation has:

- A. Increased compliance burdens

- B. Unified India’s tax system

- C. Focused on reducing exports

- D. Reduced manufacturing investments

- Which of the following is NOT a focus area of “Make in India”?

- A. Job creation

- B. Export promotion

- C. Investment in service-only sectors

- D. Regulatory simplification

Answer Key with Explanations

- B – 2014: The “Make in India” initiative was launched by the Government of India in 2014 to promote manufacturing.

- B – Position India as a global manufacturing hub: The core aim of the initiative is to make India a manufacturing powerhouse by attracting foreign and domestic investments.

- C – Electronics: PLI schemes have significantly benefited sectors like electronics, pharmaceuticals, and automobiles.

- B – Production Linked Incentives: These schemes incentivize manufacturers to scale up production and improve exports.

- A – PM GatiShakti: This program integrates logistics and infrastructure development for seamless connectivity.

- B – Removal of inter-state barriers: GST simplified tax structures, leading to efficient supply chain management and reduced barriers.

- B – Last-mile connectivity: PM GatiShakti prioritizes rural and remote area connectivity to ensure economic benefits reach all regions.

- B – GDP: Lower logistics costs as a percentage of GDP make Indian goods more competitive globally.

- B – PLI Schemes: A flagship element of “Make in India,” providing financial benefits to boost domestic manufacturing.

- C – Make in India: Simplifying regulatory procedures and promoting ease of doing business are key focus areas of the initiative.

- B – Last-mile connectivity: This ensures manufacturing hubs are connected to transportation networks, improving logistics.

- B – Advanced technologies: PLI schemes push manufacturers toward adopting innovative and efficient processes.

- B – National Logistics Policy: Focuses on creating a unified digital logistics interface to streamline operations.

- B – Unified India’s tax system: GST has made compliance easier and promoted manufacturing investments.

- C – Investment in service-only sectors: While “Make in India” supports services, its primary focus is manufacturing and exports.